sales tax on leased cars in virginia

A common exemption is purchase for. Santefejoe December 7 2019 943pm 1.

Leasing A Car And Moving To Another State What To Know And What To Do

Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq.

. My husband leased a car in Indiana and did not have to pay a sales tax. Would I have to pay the full 415 sales tax for. The actual sales tax may vary depending on the.

While Virginias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Sales tax in Virginia is levied on the ENTIRE value of. The Commissioner of Revenues Personal Property Tax Division determines the tax rate for Arlington vehicle personal property based on the following factors.

For example if you purchase a new vehicle for 50000 then you would multiply that purchase price by. 0415 and get a sales. Is there sales tax on a lease vehicle in.

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Heres an explanation for. Sales leases and rentals of motor vehicles are.

Like with any purchase the rules on when and how much sales tax youll pay. In VA you are taxed up front on the cap cost of the leased car sales tax rate of 6Fairfax county and then 415 tax rate based on the value of the car each year. Sales tax is a part of buying and leasing.

I live in Virginia. 505 Based on 1500 Google Reviews. This page describes the taxability of.

In general all sales leases and rentals of tangible personal property in or for use in Virginia as well as accommodations and certain taxable services are subject to Virginia sales and use. Motor vehicle sales leases and rentals repair and replacement parts and maintenance materials. Id like to lease car but Ive heard different things about how you pay the sales tax when leasing a car for registration in Virginia.

The sale tax on cars purchased in Virginia is 415. Vehicles leased to a person versus a business and used predominantly for non. Virginia VA Sales Tax and Lease Purchase Option.

Signature Auto Group of New York is the premiere Car Lease Experts and for those looking at sales tax on cars in virginia Auto Leases more. The vehicle is registered in the name of the leasing company and the car tax bills are sent directly to the leasing company for payment. Virginia charges a 415 Motor Vehicle Sales and Use Tax SUT on the vehicles gross sales price or 75 whichever is greater.

For vehicles that are being rented or leased see see taxation of leases and rentals. Sales tax is a part of buying and leasing cars in states that charge it. Virginia collects a 400 state sales tax rate on the purchase of all vehicles with a minimum tax of 75.

Today I signed a car 24 months car lease.

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Kia Specials West Chester Pa Kia Of West Chester

628 Penniman Rd Williamsburg Va 23185 Loopnet

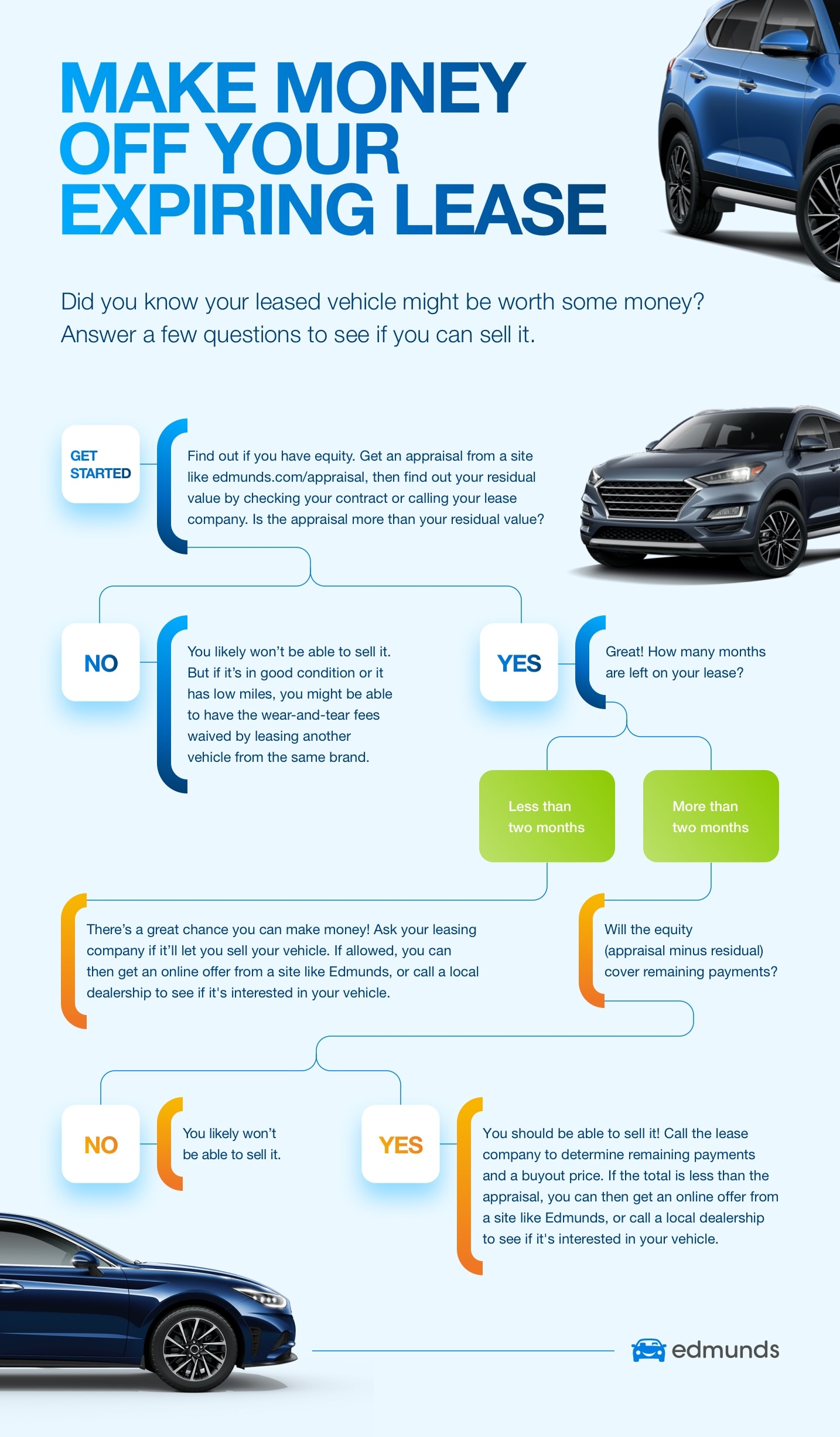

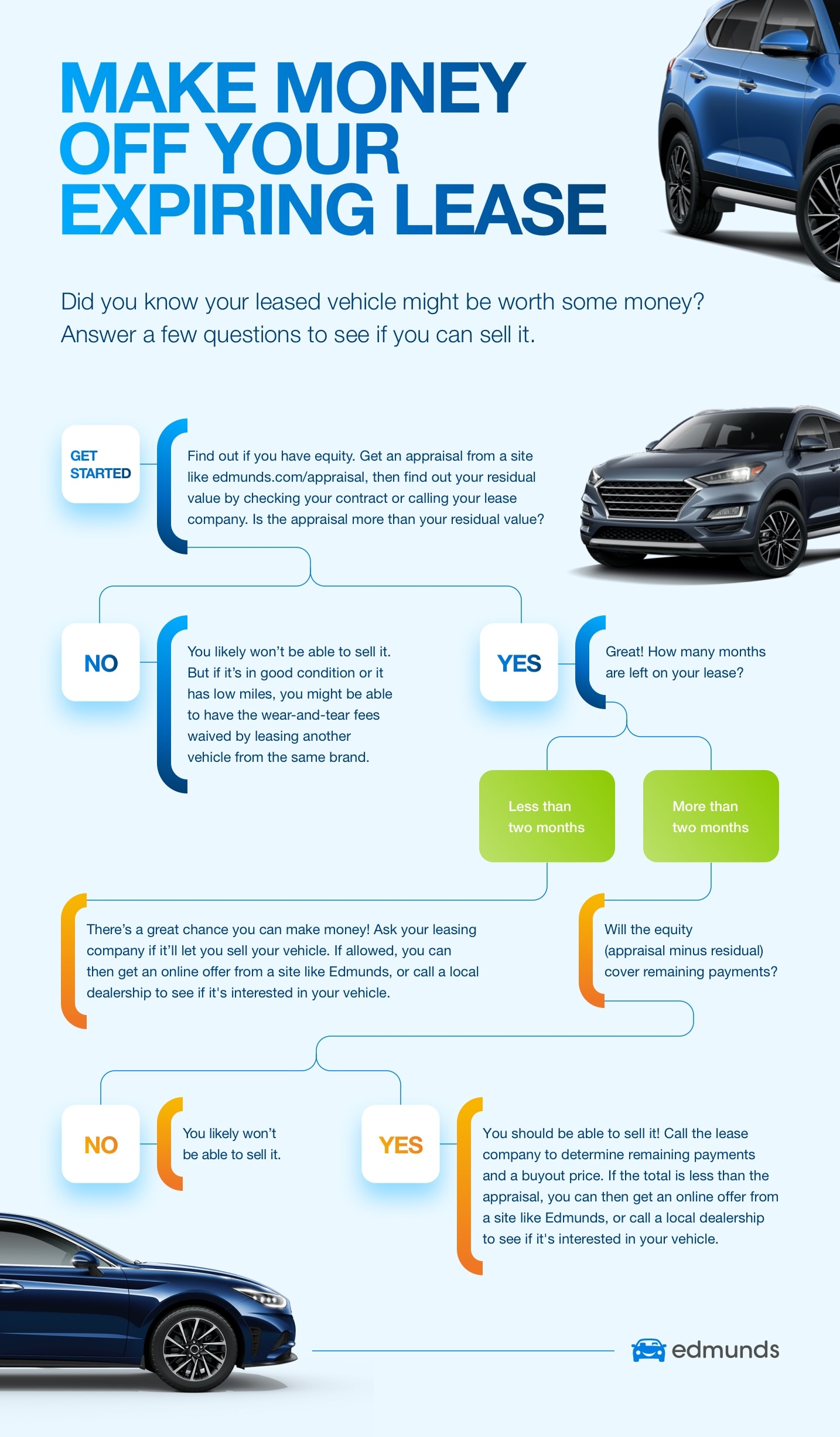

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

If I Buy A Car In Another State Where Do I Pay Sales Tax

Virginia Sales Tax Holiday Virginia Tax

Used Cars Northern Virginia Va Used Cars Trucks Va Lease Return Center

Used Cars For Sale Under 20 000 Near Me Cars Com

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

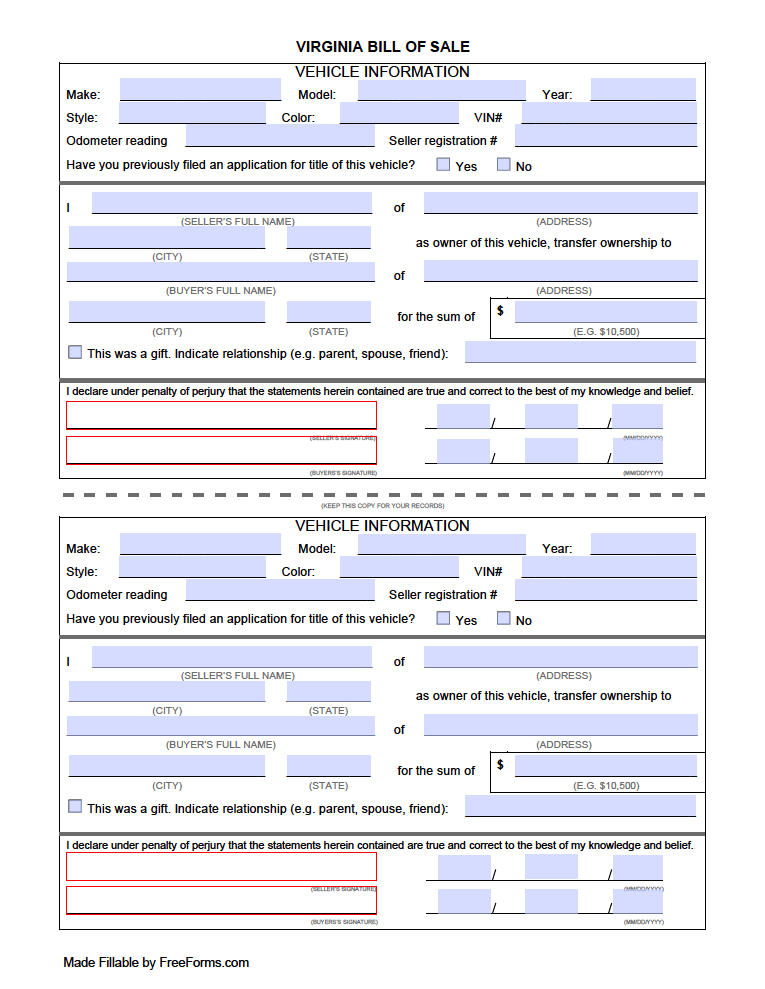

Free Virginia Bill Of Sale Forms Pdf

Used 2007 Ford Fusion For Sale In Charlottesville Va With Photos Cargurus

Johnson Family Chevrolet New Used Chevy Dealership

Virginia Vehicle Sales Tax Fees Calculator

Used Cars Northern Virginia Va Used Cars Trucks Va Lease Return Center

Virginia Vehicle Sales Tax Fees Calculator

Sales Tax On Cars And Vehicles In West Virginia